The German welfare state is generous but this leads to implicit tax rates for those on welfare that can exceed 100%. Here's a useful summary from the German newspaper Handelsblatt. (The original is in German, this is a Google translation.)

The German welfare state is generous but this leads to implicit tax rates for those on welfare that can exceed 100%. Here's a useful summary from the German newspaper Handelsblatt. (The original is in German, this is a Google translation.)

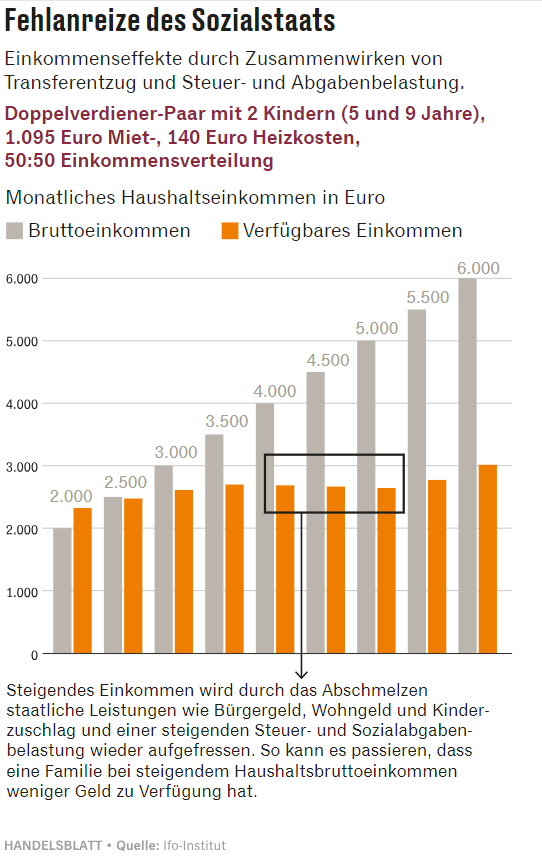

Poorly coordinated state benefits such as the citizen's allowance, housing benefit or child allowance often mean that additional work is not worthwhile or, in extreme cases, even leads to lower net income. The Ifo Institute has calculated this for various household types for the Handelsblatt newspaper - and shown how anti-performance the system sometimes is.

..A dual-income couple with two children aged five and nine, who work full-time and each earn 2000 euros gross per month, have a net income of 2686 euros with rent and heating costs of 1235 euros.

The couple therefore only has 887 euros more at their disposal per month than the household receiving citizen's allowance. The absurd thing is that if the model working couple increases their joint income to 5,000 euros, the household's net income falls by 43 euros to 2,643.

The graph shows that from a gross monthly income of 2000 Euro ($2150) (gray bars) to 6000 Euro ($6450) the net income gradient (orange bars) is nearly flat and in some regions it actually falls--meaning the couple would be better off by not working.

It's hard to solve these problems. A negative income tax in which benefits would fall more slowly with income can restore incentives but at the price of having many more people on some welfare and a a much higher budgetary cost.